i-SIGMA Members Agree: Not as Bad as First Feared but Not Over Quickly Either

August 26, 2020

The results of the fifth Member Sentiment Survey reflect the reality that first appeared last month.

As readers will remember, when the lockdown orders first appeared around the world, most service providers felt the impact on revenues would be devastating, while thinking (perhaps wishfully) at the same time that it would only last a few months.

Last month, for the first time we saw evidence that members had come to believe the exact opposite: Revenues would not fall to zero, but that the impact (though not as severe) would be with us for much longer.

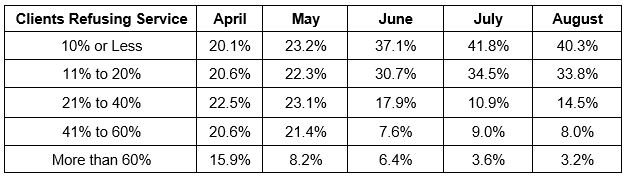

Customers No Longer Needing Service

Though down slightly, there was little change in the number of clients who were not accepting service at this point, with 40% of respondents reporting it was less than 10% of their total clientele, and nearly 34% reporting it was 20% or less. At this point, the survey has not differentiated between the percentage of clients refusing service is temporary or permanent.

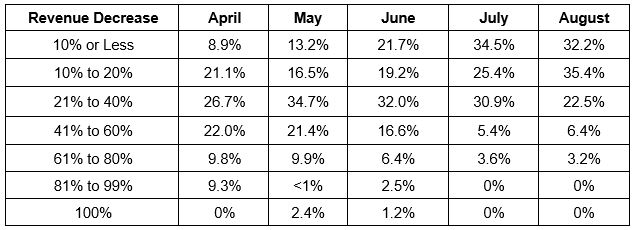

Revenue Decrease

The chart below indicates service providers seeing a 10% or less decline in revenue is steady, while the number of service providers showing a 20% or more decline increased. Rather than being negative, it appears the increase is an improvement, since service provider experiencing a decline of 20% or more decreased substantially. Between April and August, service providers reporting a revenue decrease of 40% or more shrank from 20% to 10%.

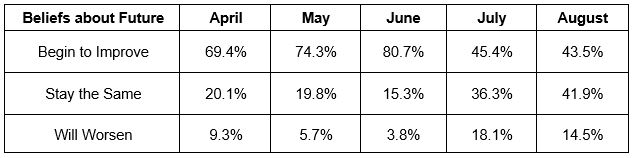

Recovery Outlook

When asked about the prospects over the coming months, again, though there was little change, it was for the better. Though most month on month, the percent of the most optimistic respondents remained about the same, those predicting a worsening business climate seem to be slowly migrating to the belief that things will remain the same. That said, statistically speaking, given the margin of error, the change is not significant.

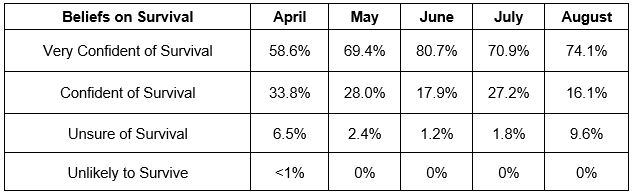

Chances of Survival

And finally, and perhaps most concerning, the percentage of service providers worried about their survival rose dramatically from 2% in July to 10% in August. Some solace can be taken from the fact that those reporting they were “very confident” of survival increased. Speculation is that those now concerned about their long-term survival are reacting to the extended recovery period as well as continued news about trends toward remote working and digitization.

Commenting on the monthly surveys, i-SIGMA CEO says it may be time to expand its scope. “Now six months in, questions about members’ experiences and concerns have changed. We not only have to modify the questions, but we may find member focus groups and client focus groups helpful. In the end, this is all about providing members with information that helps the better navigate.”