i-SIGMA Member Sentiment on Recovery Continues to Improve

July 29, 2020

While i-SIGMA members continue to see improvements in the economy, the most recent Member Sentiment Survey shows steady improvement in all but one of the five issues the association polled.

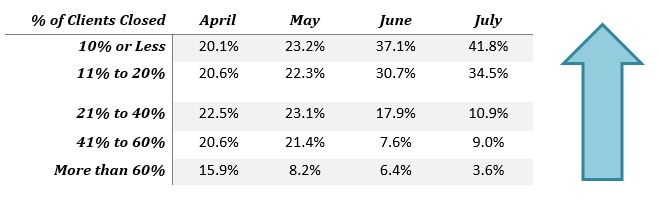

1.) Percentage of Clients Temporarily Closed Due to the Shutdown

A month-over-month comparison clearly shows that the best-case scenario (10% or less client closures) is increasing, while the worst-case scenarios (with a larger percentage of client closures) are steadily decreasing. This means fewer clients are closed than originally experienced and that the situation is improving. All in all, it is a good result.

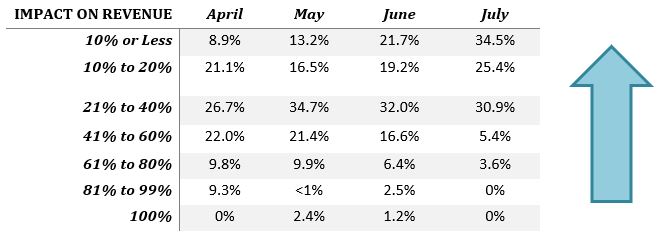

2.) Revenue Due to the COVID-19 Lockdown

When it comes to the percent of revenue decrease due to the shutdown, we see the same thing. The percent of members experiencing the best-case scenario, where revenue is down 10% or less, is steadily increasing, while those experiencing the worst-case impacts is steadily shrinking. It is, however, worth noting that members in the middle – those seeing a 21% to 40% decrease in revenue – has increased slightly. Admittedly, it is hard to characterize a 21% to 40% decrease in revenue as a best-case, so there is some concern over a slight increase there. In general, however, readers should feel good about the direction this is trending.

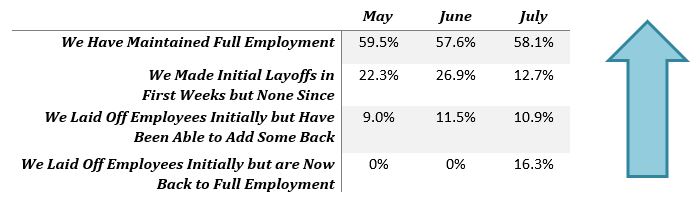

3.) Layoffs/Employment

Though we did not start asking this question until the May survey, industry employment trends also provide a reason for optimism. Those maintaining full employment is stable, at just below 60%, which shows things are not worsening, while, on the positive side of things, over 16% of respondents reported they made initial layoffs but have returned to full employment.

(Note: The 0% reflected below show there were no members who initially made layoffs and then were back to full employment in those months.)

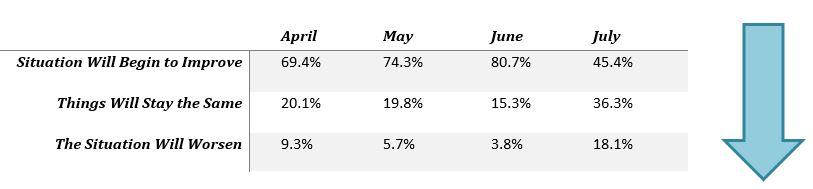

4.) Outlook over the Next 3 Months

It appears, despite other optimistic trends, i-SIGMA members have taken a sharp turn in their thinking on the duration of the recovery period. As the chart below indicates, after showing several months of increasing optimism, the number of respondents thinking the recovery would happen anytime soon recently declined precipitously. It appears that of those who no longer expect a quick recovery, many now believe that things will either “stay the same” or “the situation will worsen.”

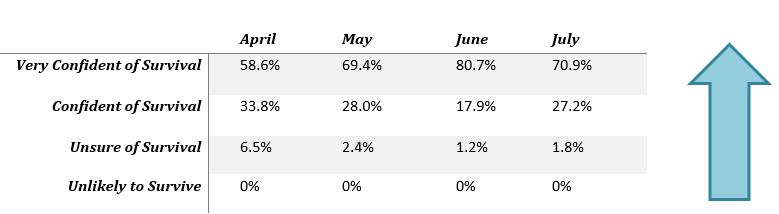

5.) Chance of Surviving

On the question of surviving the shutdown, the July member sentiment survey remained overall positive. Looking at the combined results of “Very Confident of Survival” and “Confident of Survival,” members have consistently hovered just short of 100%. In fact, only in the first survey did a significant percentage of respondents reported that they were “Unsure” or “Unlikely” to survive.